How to Set Stop-Loss and Take-Profit Orders Effectively

Trading successfully requires more than market knowledge; it demands disciplined risk management. Stop-loss and take-profit orders serve as essential tools to protect capital and secure gains.

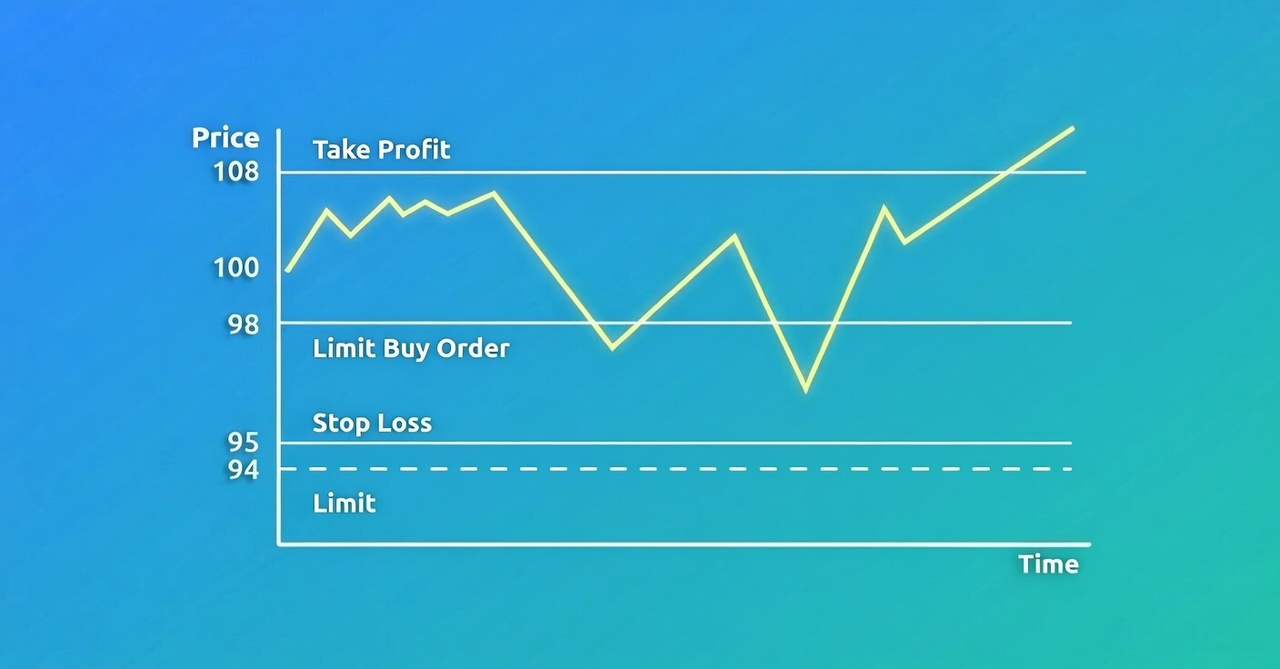

A stop-loss limits potential losses on a trade, while a take-profit locks in profits when a target price is reached.

Placing these orders effectively ensures trades remain aligned with strategy and mitigates emotional decision-making. Traders in stocks, forex, and cryptocurrencies benefit from structured order placement.

Understanding Stop-Loss Orders

Stop-loss orders function as a safety net in trading by automatically closing positions when prices reach a predetermined level. They protect capital from unexpected market movements and prevent emotional trading mistakes.

There are several types of stop-loss orders. A fixed stop-loss is set at a specific price point based on risk tolerance. A trailing stop-loss moves with the market, locking in gains while allowing the trade to continue in a favorable direction.

Volatility-based stop-losses adjust dynamically according to market fluctuations, providing a buffer during unpredictable conditions. Placement depends on factors such as market volatility, trade timeframe, and overall strategy.

Common mistakes include setting stops too tight, which triggers early exits, or too loose, which exposes the trade to excessive loss. Correct positioning ensures losses remain manageable while allowing the trade sufficient space to develop.

Understanding Take-Profit Orders

Take-profit orders aim to secure profits once a trade reaches a target level. They reduce the need for constant monitoring and protect gains in volatile markets.

Fixed take-profit orders close positions at a predetermined price, while scaling out or tiered profit-taking gradually closes portions of a trade to lock in partial profits. Risk-to-reward-based targets set profit levels proportionate to the stop-loss, ensuring consistent trade planning.

Key considerations for setting take-profit levels include market structure, momentum, and trend strength. Understanding support and resistance zones helps identify realistic exit points.

Proper take-profit placement also strengthens psychological discipline, reducing the temptation to exit trades too early or hold positions beyond rational limits. Consistency in profit targets ensures trades align with overall strategic objectives.

Strategic Placement of Stop-Loss and Take-Profit Orders

Maintaining a balanced risk-reward ratio is critical for trading success. Methods for calculating optimal stop-loss and take-profit levels include percentage-based techniques, where risk is defined as a fixed portion of the account balance.

ATR (Average True Range) can determine appropriate distances for stops and profit targets based on market volatility.

Technical analysis identifies levels such as support, resistance, and chart patterns to position orders intelligently. Arbitrary placements often result in losses or missed opportunities.

Market conditions demand occasional dynamic adjustments, ensuring stop-losses and take-profits respond to trends, volatility spikes, or sudden news events. Properly placed orders provide a structured approach, safeguarding capital while maximizing profit potential.

Exchanges like Zoomex Spot trading provide tools to manage these orders efficiently, enhancing both security and execution speed. Improper placement, however, can erode profits or amplify losses, emphasizing the importance of precise planning.

Tools and Techniques for Precise Order Setting

Modern trading platforms offer multiple tools to aid precise stop-loss and take-profit placement. Charting software provides visual analysis and automated alerts. Volatility indicators allow traders to adjust stops dynamically, reflecting changing market conditions.

Risk calculators and position sizing tools ensure order levels align with overall portfolio risk management.

The following table illustrates suggested risk-reward ratios and order placements for different trading strategies:

| Trading Strategy | Suggested Risk-Reward Ratio | Stop-Loss Placement | Take-Profit Placement | Notes |

| Scalping | 1:1.5 | Near support/resistance | Slightly beyond recent high/low | Quick trades, tight spreads |

| Swing Trading | 1:2 | Below key support/trendline | At the target trend reversal | Medium-term trades |

| Trend Following | 1:3 | ATR-based or below the trendline | Multiple profit-taking levels | Long-term trend adherence |

| Breakout Trading | 1:2 | Just below the breakout point | Next resistance/psychological level | High volatility environments |

Combining technical indicators with calculated risk-reward ratios improves order precision and enhances consistency in trade outcomes.

Common Pitfalls and How to Avoid Them

Errors in stop-loss and take-profit placement can undermine any trading plan. Stops that are too tight lead to premature exits, while excessively wide stops expose capital to significant loss. Ignoring volatility or trend analysis reduces the effectiveness of exit orders.

Unrealistic take-profit levels can leave gains on the table or trigger emotional trading. Psychological biases often interfere, including fear-induced early exits or greed-driven delayed profit-taking. Discipline is key; pre-set orders should be respected unless valid strategy adjustments dictate otherwise.

Maintaining a systematic approach prevents impulsive decisions and ensures trades remain consistent with long-term objectives.

Leveraging Cryptocurrency Trading Platforms for Effective Orders

Risk management is more efficient on Zoomex thanks to its stable infrastructure and real-time execution engine. Supporting 590+ perpetual contracts alongside spot markets, the platform allows traders to deploy automated exit strategies without performance delays.

Its multi-signature cold and hot wallet architecture adds asset protection, while consistent market depth ensures stop-loss and take-profit orders are filled accurately, even during rapid price movements.

Advantages of Zoomex in order management include:

- Lightning-fast order execution

- Multi-signal wallet system ensuring asset security.

- Flexible options for both novice and professional traders

- 24/7 multilingual support for trading guidance

This approach aligns trading with disciplined risk management principles, allowing precise and effective order placement even during volatile conditions.

Advanced Strategies for Dynamic Order Management

Dynamic order management enhances profitability in fluctuating markets. Trailing stop losses allow trends to continue while protecting accumulated gains. Partial profit-taking balances risk and reward, securing profits without prematurely exiting a trade.

Adjusting stop-loss and take-profit levels in response to market volatility or economic news ensures trades remain strategically aligned. Incorporating major events, earnings reports, or policy announcements can inform necessary order modifications.

Automation and algorithmic tools allow faster, more accurate adjustments, reducing human error and supporting complex strategies. Strategic flexibility and timely intervention maximize the potential of each trade while minimizing unnecessary risk exposure.

Conclusion

Effective stop-loss and take-profit orders are cornerstones of disciplined trading. Their strategic placement combines analysis, risk management, and psychological control. When executed correctly, these orders reduce exposure, lock in gains, and reinforce consistent decision-making.

Leveraging advanced platforms enhances precision and efficiency, while dynamic strategies allow adaptation to market shifts.

A structured approach ensures trading aligns with long-term goals, increases confidence, and improves overall profitability. Consistency, discipline, and a clear methodology form the foundation for sustained trading success.

Jim's passion for Apple products ignited in 2007 when Steve Jobs introduced the first iPhone. This was a canon event in his life. Noticing a lack of iPad-focused content that is easy to understand even for “tech-noob”, he decided to create Tabletmonkeys in 2011.

Jim continues to share his expertise and passion for tablets, helping his audience as much as he can with his motto “One Swipe at a Time!”