Optimise Your Financial Workflows with a Bank Transaction API

Modern businesses live and die by how well they handle money. Payments, reconciliations, cash flow forecasts — if these workflows are slow or error-prone, they hold growth back. This is where a bank transaction API can transform operations.

A bank transaction API connects your systems directly to banks, enabling secure access to transaction data and payment processing in real time. Instead of relying on manual processes or outdated integrations, businesses can streamline operations, cut costs, and gain sharper financial insights.

This article explains what a bank transaction API is, how it works, and how different industries can use it to scale.

What Is a Bank Transaction API?

At its core, a bank transaction API (application programming interface) is a digital bridge between your business systems and the banking network. With user consent, it allows businesses to:

- Access account balances in real time

- View transaction histories with detailed information such as dates, amounts, and descriptions

- Process payments and payouts securely, without intermediaries

- Check payment statuses instantly to reduce uncertainty

- Collect metadata that helps categorise and analyse transactions

Unlike manual reconciliation or screen scraping, APIs deliver clean, secure, and structured data that your systems can use immediately.

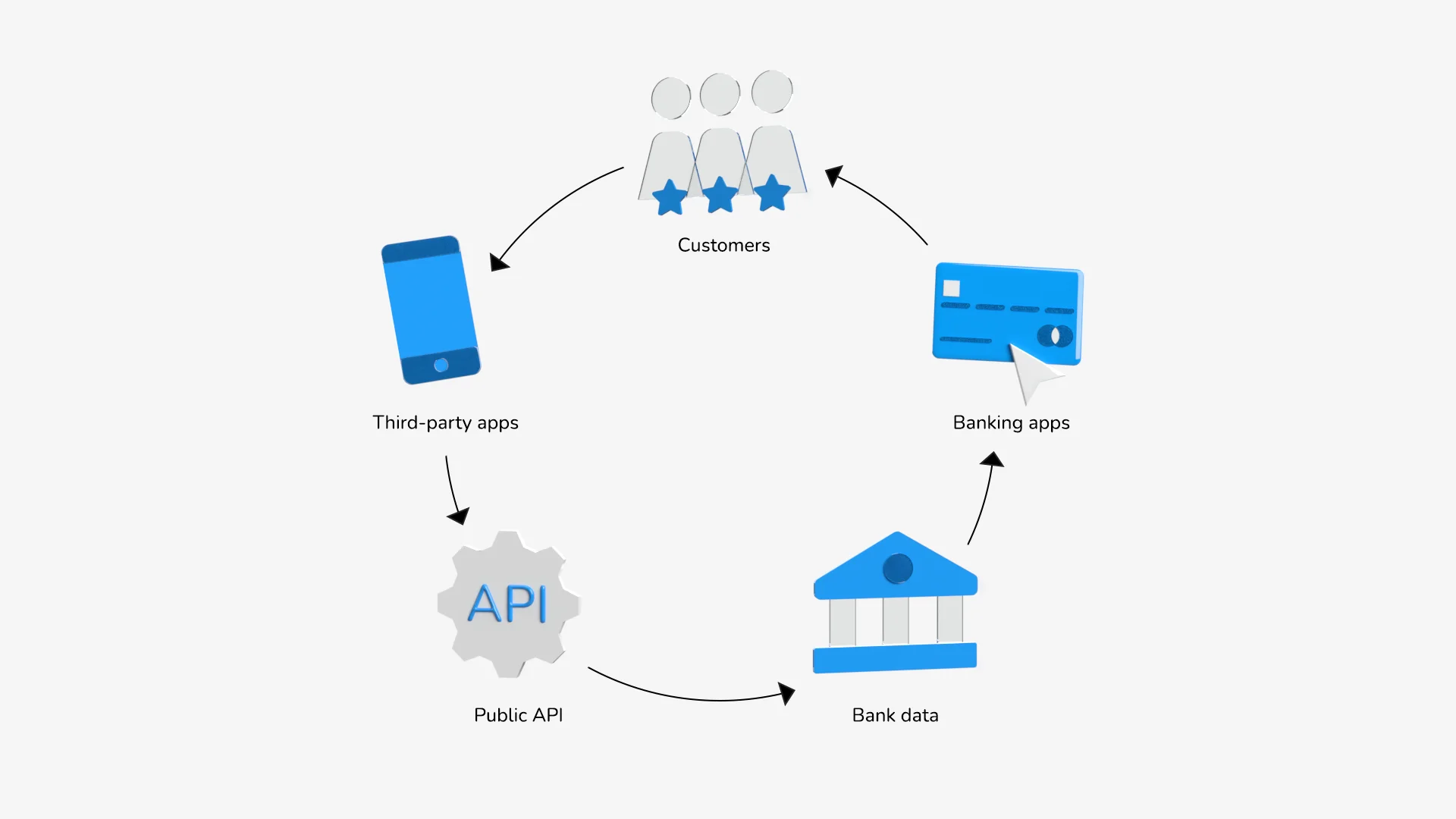

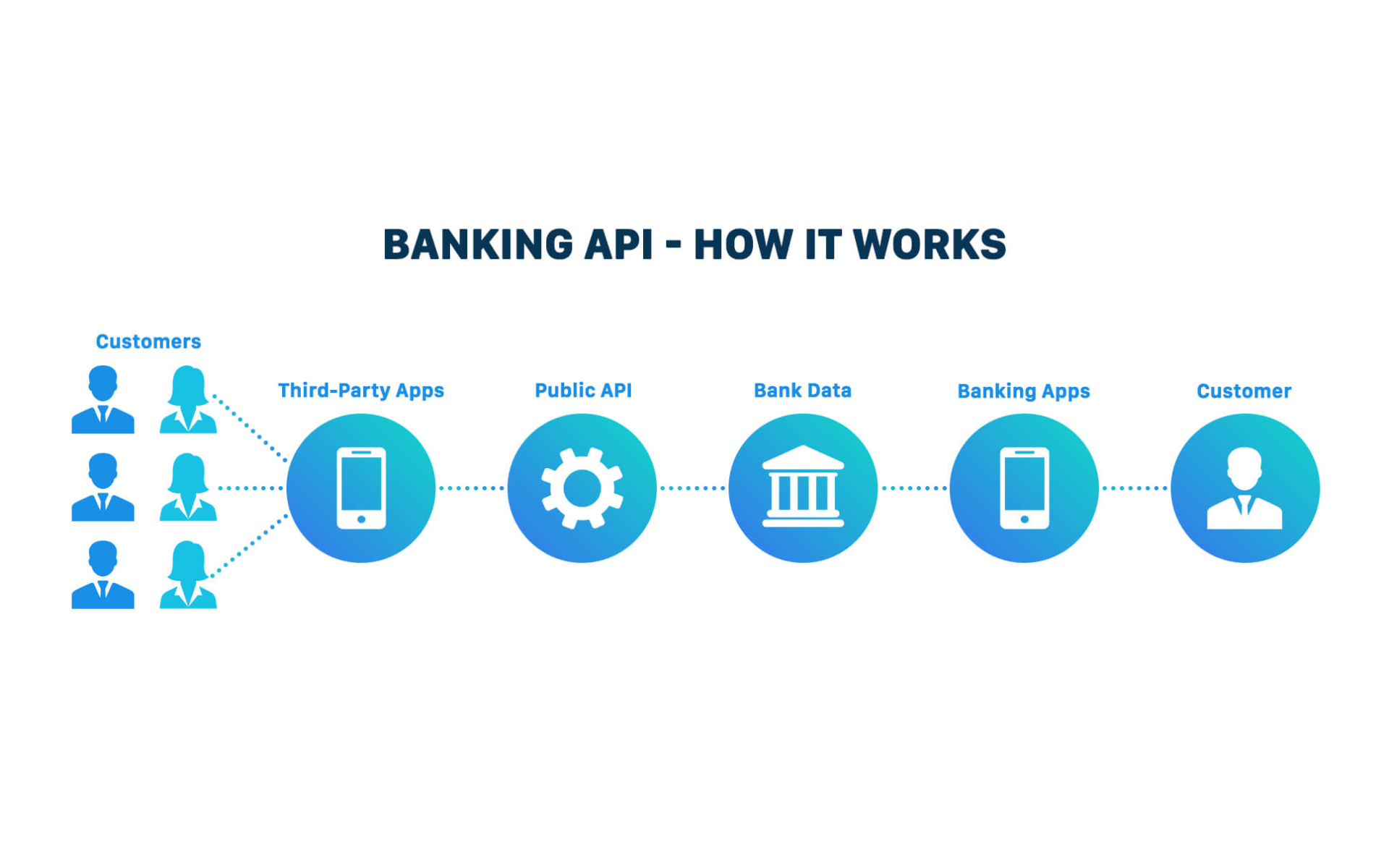

How Does a Bank Transaction API Work?

Think of it as a two-way channel. When accessing data, your system sends a request for specific information such as balances, recent payments, or statuses.

The bank then verifies consent and authenticates the request, often using multi-factor security, before sending the information back in a structured, machine-readable format. Once received, the data flows straight into your workflows, powering tasks like reconciliation, reporting, or credit scoring.

For payments, the process works in reverse. Your system initiates a payment request with the required details, which the account holder authorises through their bank.

The bank processes the transaction, confirms completion, and sends real-time status updates back into your system. This creates faster, more reliable operations without the inefficiencies of manual checks.

Why Bank Transaction APIs Matter for Businesses?

Financial leaders are under constant pressure to cut costs, scale efficiently, and reduce risk. A bank transaction API supports all three.

First, it provides real-time financial visibility. This helps prevent fraud, improve cash flow forecasting, and reassure customers with instant confirmations.

Second, it reduces operational overhead. Automation replaces repetitive tasks such as reconciliation, freeing teams to focus on growth.

Third, it supports scalable infrastructure. As transaction volumes increase, the same API can grow with your business, handling millions of transactions across multiple currencies without extra integrations.

For many businesses, the case for adopting a bank transaction API becomes clear when looking at measurable outcomes:

- Up to 15–20 staff hours saved weekly through automation of reconciliation

- Reduced chargeback rates thanks to real-time fraud monitoring

- Faster settlement cycles, improving cash flow and liquidity

- Improved customer satisfaction from instant refunds and seamless payments

Practical Applications Across Industries

Bank transaction APIs are not confined to a single sector — their value is already reshaping industries in very different ways.

In e-commerce, they power instant payouts for marketplace sellers, making cash flow faster and more predictable. Customers also benefit from quick, transparent refunds, while merchants gain protection through fraud detection that spots unusual transaction patterns.

Historical data can be turned into forecasts, helping online businesses predict cash flow with greater accuracy.

The travel and hospitality sector is using APIs to handle complex, global payments. Multi-currency bookings become smoother, cancellations can be refunded in real time, and deposits are secured through pre-authorisation.

Behind the scenes, commissions across multiple partners are reconciled far more efficiently, reducing back-office workload.

In gaming and entertainment, speed and trust are critical. APIs allow players to deposit or withdraw funds instantly, switch payment methods without friction, and enjoy automated payouts that align with their preferences and regional rules.

At the same time, operators can monitor transactions to enforce responsible gaming policies and analyse player behaviour to design smarter retention strategies.

How to Get Started?

Integrating a bank transaction API may sound complex, but it often requires less time than maintaining multiple manual processes. A practical approach is:

- Map your workflows — Identify where delays or errors cost time or money (e.g., reconciliation, payouts, reporting).

- Set priorities — Decide whether you need faster payments, richer insights, or both.

- Evaluate providers — Compare APIs based on the features listed earlier, focusing on scalability and compliance.

- Start with a pilot — Integrate the API into one workflow first, test the impact, then expand gradually.

What to Look for in a Bank Transaction API Provider?

Not all APIs and API providers are created equal. When evaluating providers, decision-makers should pay attention to:

- Real-time data access and security — Is data updated instantly, and is it protected by strong compliance standards such as GDPR and PSD2?

- Multi-currency and cross-border support — Can the API handle transactions in different currencies for international growth?

- Automation capabilities — Does it remove the need for manual reconciliation and free up staff time?

- Flexible integration options — Are there no-code tools, e-commerce plugins, or direct integrations that fit your systems?

- Scalability — Will it adapt to higher transaction volumes as your business expands?

Choosing a provider with these capabilities is an investment in long-term efficiency.

Final Thoughts on Bank Transaction API

In today’s economy, financial workflows can make or break growth. Manual processes are no longer fit for businesses that need to move fast, scale across markets, and deliver seamless customer experiences.

A bank transaction API brings speed, accuracy, and visibility into the heart of financial operations. By automating reconciliation, providing real-time insights, and supporting scalable growth, it allows businesses to focus on strategy rather than admin.

For decision-makers — from founders to finance leads — the question is no longer whether to adopt one, but how quickly. The sooner you take advantage of a bank transaction API, the sooner your business can operate with the speed and intelligence today’s market demands.

Jim’s passion for Apple products ignited in 2007 when Steve Jobs introduced the first iPhone. This was a canon event in his life. Noticing a lack of iPad-focused content that is easy to understand even for “tech-noob”, he decided to create Tabletmonkeys in 2011.

Jim continues to share his expertise and passion for tablets, helping his audience as much as he can with his motto “One Swipe at a Time!”